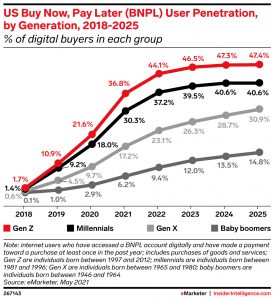

Changes in online shopping behavior led by millennials have fueled the rise of Buy Now, Pay Later (BNPL) solutions.

BNPL is the modern version of layaway (sometimes called lay-buy) – well, sort of. Back in the day, many brick-and-mortar retailers would offer shoppers the ability to put some money down to hold an item and pay off the remaining balance on a designated schedule. Of course, this all came with fees.

BNPL lets online consumers break up the total price of an item into equal payments (often 2 or 4) when they are checking out. The consumer receives the item (unlike layaway where the total needed to be paid before the shopper was able to go home with the product) in exchange for being approved by the BNPL provider and agreeing to have their credit card automatically billed for the remaining installments. This typically occurs with 0% interest payments and no late fees or hidden fees.

BNPL is set to account for 4.2% of all global e-commerce payments in 2024, according to a WorldPay Global Payments Report from January 2021. In 2019, the $60 billion BNPL market represented 2.6% of global e-commerce (excluding China); Worldpay estimates that it will grow at a compound growth rate (CAGR) of 28% annually to reach a staggering $166 billion by 2023.

Other estimates are even bigger. According to the report published by Allied Market Research, the global buy now pay later market generated $90.69 billion in 2020, and is projected to reach $3.98 trillion by 2030, witnessing a CAGR of 45.7% from 2021 to 2030.

WorldPay predicts that payments in North America will increase from 1.6% in 2020 to 4.5% in 2024. The EMEA region (Europe, Middle East, Africa) represents the largest users of BNPL solutions globally, accounting for 7.4% of ecommerce payments by 2020 and increasing to 13.6% by the end of 2024.

In the APAC region (Asia-Pacific), 0.6% of 2020 ecommerce payments are made using BNPL and will grow to 1.3% in 2024. While this number may not be the largest, it’s important to note the dominance of digital/mobile wallet payment options such as WeChat in China is set to account for 65.4% of all ecommerce payments in the region in 2024. However, BNPL methods will overtake pre-paid cards and deferred debit cards as a preferred option in APAC by 2024.

BNPL Taking Affiliate Channel by Storm

Over the last decade, BNPL has garnered a very high-profile presence in the affiliate marketing space.

More publishers have landing pages devoted specifically to promoting merchants that offer BNPL options at checkout. Additionally, nearly all of the BNPL service providers themselves are also now affiliates. Most have marketplaces that typically include store listings and promotional offers.

And some BNPL providers are adding a loyalty component. With the BNPL solution Klarna consumers have the choice to choose where they redeem points. Findings from a recent Worldpay from FIS survey show that 81% of global consumers stated they would like the ability to earn points and redeem those points at multiple types of retailers.

Millennials Lead the Way

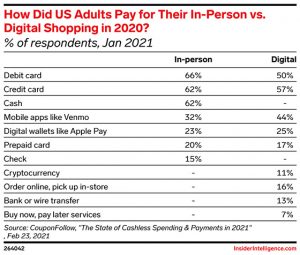

For many, BNPL is an alternative to credit cards. It appeals to millennials who are turning to emerging finance and banking options (ditching credit cards) in order to avoid debt. According to a report by consulting firm Deloitte, only 1 in 3 millennials have a credit card.

And GenX is also embracing BNPL. This group has shown the need to be more financially savvy because of so many issues including caring for aging parents, still paying for their children’s expenses, student loan debt, credit card debit. Additionally this demographic has faced three market-correcting job industry downturns in the last 20 years.

BNPL Landscape

Affirm was among the first FinTech companies to offer BNPL. The space has several high-profile players including Klarna, Zip (previously named QuadPay), Sezzle, PerPay Splitit, AfterPay (recently bought by Square for $29 billion), and more. PayPal has built its own in-house BNPL option, called Pay-In 4.

BNPL got even more legitimized in late August with two of the world’s biggest companies announcing partners with BN{L solution providers.

Amazon announced it was working with Affirm. Under the terms of the agreement, Amazon customers will now be able to split purchases over $50 into monthly payments. The offering is currently in test mode and will be rolled out more broadly in the next few months.

Apple also recently partnered with Affirm to bring its service to Canadian customers of the iPhone, iPad, and Mac and is also working on offering a similar payment option in the US, according to several reports.

BNPL and the Affiliate Channel

The service is gaining immense popularity with merchants. Many merchants claim that offering BNPL can lead to increased sales among those on a tight budget, shoppers hesitant to make a larger purchase, and those seeking alternative payment methods.

Here are some additional BNPL benefits for merchants:

- Access highly engaged younger consumer demographics via mobile

- Users are loyal to their preferred BNPL partner (via shopping cart & app) and mostly shop exclusively via one BNPL service provider.

- Users show a higher intent to purchase while using BNPL platforms.

- 60% of customers are new to file (according to CJ Affiliate)

- As users have more time to pay for items with a higher intent to purchase, there are 50% fewer returns.

- BNPL platforms take on any payment risks including possible payment delays or defaults.

And according to BNPL provider ZIP, having this option at checkout increases average-order-value (AOV) by 70% and repeat purchases by 80% compared to other payment options. CJ Affiliate estimates that AOV is increased by $375 when BNPL is used and can lead to increased conversions as they attract shoppers who might not purchase high ticket items otherwise and are also doing so without discounts.

For affiliates, there is a real opportunity to promote these brands and deliver a much-desired alternative way to pay for their respective audiences. Many affiliates are creating BNPL landing pages that feature all the merchants they work with that provide these different payment options. Anecdotally, a handful of affiliates we spoke with said that traffic to those BNPL pages is more than 5x other pages on their sites and on average accounts for nearly 60% of their monthly commissions.